Gold has smashed through the historic $4,000-per-ounce barrier for the first time, marking an extraordinary achievement in the precious metal’s remarkable 2025 performance. Spot gold surged past $4,000 on Wednesday, driven by a powerful combination of factors including the ongoing US government shutdown, Federal Reserve rate cut expectations, record ETF inflows, and escalating global geopolitical tensions.

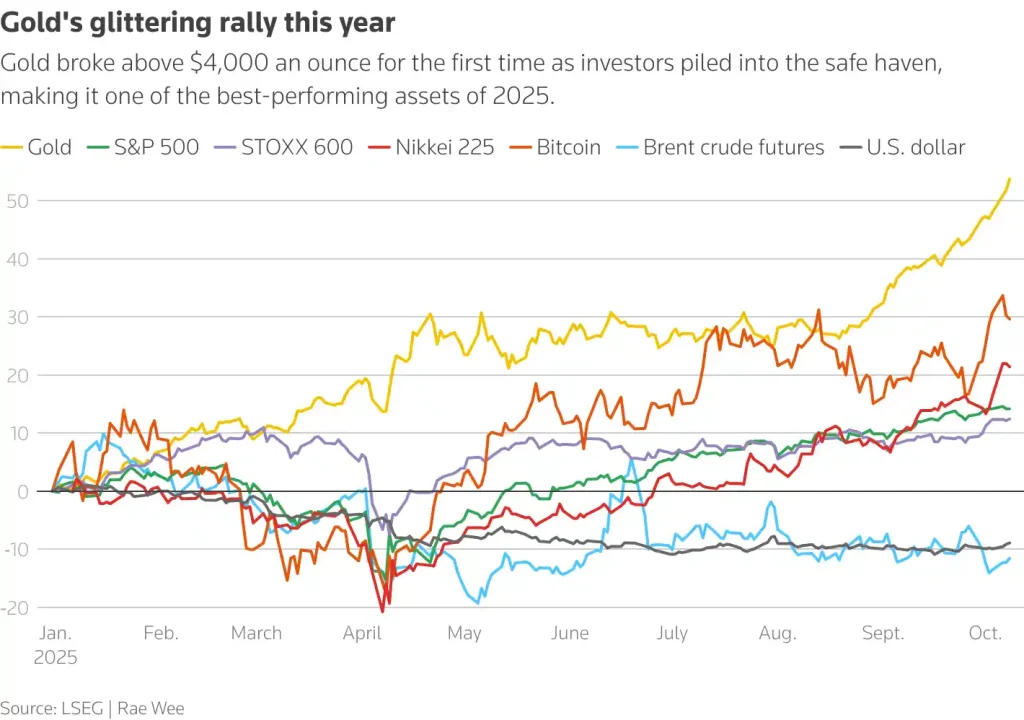

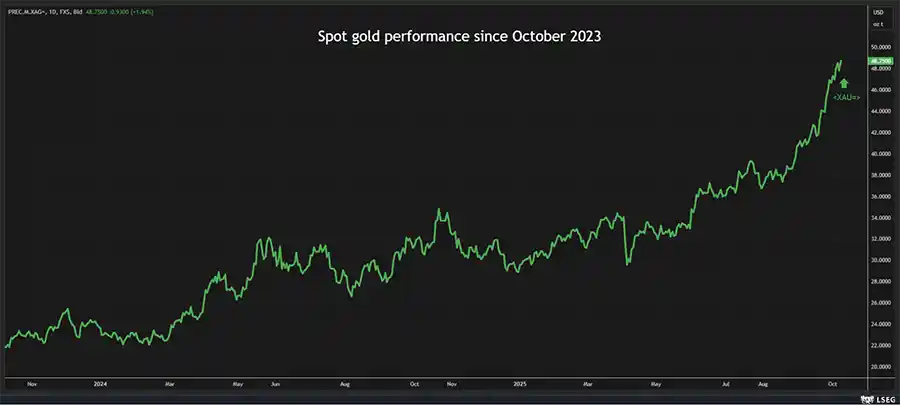

The yellow metal’s unprecedented ascent represents a staggering 54% year-to-date gain after posting a 27% increase in 2024, establishing gold as one of 2025’s strongest-performing assets. This historic rally has outpaced global equity markets, bitcoin, and virtually every major asset class, while the US dollar and crude oil have declined year-to-date.

Spot gold traded at $4,036.22 per ounce, up 1.3% as investors worldwide rushed to secure positions in the ultimate safe-haven asset amid unprecedented economic and political uncertainty.

US Government Shutdown Accelerates Safe-Haven Demand

Eighth Day of Shutdown Drives Uncertainty

The US government shutdown, entering its eighth day on Wednesday, has significantly amplified gold’s appeal as investors seek protection against policy paralysis and economic disruption. The shutdown has delayed critical economic data releases, forcing market participants to rely on alternative sources for assessing the economy’s trajectory.

StoneX analyst Rhona O’Connell noted that “the government shutdown is not impeding strong equities but nonetheless there will be a degree of risk mitigation via bullion.” This dual dynamic—strong equity performance alongside rising gold prices—reflects sophisticated investor strategies employing precious metals as portfolio insurance.

Missing Economic Data Complicates Fed Outlook

The shutdown’s impact on data availability has created additional market uncertainty regarding the Federal Reserve’s monetary policy path. Without official employment reports, inflation data, and GDP figures, investors face heightened difficulty in forecasting economic conditions and central bank responses.

Despite data limitations, markets are pricing in a 25-basis-point rate cut at the Fed’s upcoming meeting, with similar expectations for December. This anticipated monetary easing represents a powerful tailwind for gold, which typically thrives in lower interest rate environments.

Record ETF Inflows Power Historic Surge

$64 Billion Year-to-Date Flood into Gold Funds

Global gold ETF inflows reached approximately $38 billion in the first half of 2025 alone, reflecting unprecedented institutional and retail investor demand for precious metals exposure. This marks the first time in five years that developed-market ETFs have experienced sustained accumulation, according to Deutsche Bank precious metals analyst Michael Hsueh.

The September surge was particularly dramatic, with gold ETF trading volumes exploding to $8 billion per day, an 84% month-over-month increase. North American funds led this charge, accounting for 78% of physically gold-backed ETF trading volumes.

Western Investors Return After Five-Year Absence

The renewed Western investor participation represents a fundamental shift in gold market dynamics. After years of net outflows from developed-market gold ETFs, institutional money managers and individual investors have aggressively rebuilt precious metals allocations as economic uncertainties have intensified.

This return of Western capital, combined with consistent Asian demand, has created extraordinarily strong bid-side pressure that continues pushing gold to successive record highs.

Federal Reserve Rate Cut Expectations Boost Appeal

Lower Interest Rates Enhance Gold’s Competitiveness

Gold, which pays no interest or dividends, becomes increasingly attractive relative to interest-bearing assets when yields decline. With the Federal Reserve expected to implement multiple rate cuts through 2026, gold’s opportunity cost diminishes substantially, making the precious metal more competitive in diversified portfolios.

UBS analyst Giovanni Staunovo emphasized that “for the time being, Trump wants to see lower U.S. interest rates and that should keep increasing the appeal of gold.” This political pressure for monetary easing adds another dimension to gold’s bullish narrative beyond traditional economic factors.

Real Yields Remain Favorable for Precious Metals

Even as nominal yields fluctuate, real yields (interest rates adjusted for inflation) remain relatively low by historical standards. This environment is particularly conducive to gold appreciation, as the metal serves as an inflation hedge and store of value when real returns on fixed-income investments are compressed.

Analysts at State Street Investment Management estimate a 75% probability that gold will maintain levels above $4,000 through the fourth quarter and into early 2026, reflecting confidence in supportive monetary conditions.

Central Banks Continue Aggressive Gold Accumulation

Third Consecutive Year Above 1,000 Tonnes

Central bank gold purchases topped 1,000 tonnes for the third consecutive year, demonstrating sustained official sector demand that provides fundamental support beneath gold prices. This aggressive accumulation reflects central banks’ strategic efforts to diversify foreign exchange reserves away from dollar-dominated assets.

China’s central bank, the People’s Bank of China, continued adding to gold reserves in January 2025, increasing holdings to 2,285 tonnes, representing 5.9% of total foreign reserves. This deliberate reserve diversification by the world’s second-largest economy exemplifies the broader trend among central banks globally.

De-Dollarization Trend Supports Gold Demand

Many emerging market central banks view gold accumulation as a hedge against US dollar volatility and potential sanctions risks. This structural shift toward gold-backed reserve diversification represents a long-term demand catalyst that transcends cyclical economic factors.

The consistency of central bank buying—maintaining 1,000+ tonne annual purchases for three years—provides a reliable demand floor that supports gold prices even during periods of reduced retail or investment demand.

Geopolitical Crises Amplify Safe-Haven Flows

Multiple Global Flashpoints Drive Hedging

The ongoing Middle East conflict, Russia-Ukraine war, and political instability in France and Japan have created a complex web of geopolitical risks that drive investors toward safe-haven assets. Gold’s traditional role as a crisis hedge has proven particularly valuable amid this multifaceted global uncertainty.

Unlike financial assets tied to specific countries or regions, gold represents universally recognized value that transcends political boundaries and sovereign risks. This quality becomes especially prized when multiple geopolitical crises unfold simultaneously.

Political Uncertainty in Major Economies

Political turmoil in France and Japan—two G7 economies—has further intensified demand for assets uncorrelated with political risk. These developed-market uncertainties, combined with emerging market challenges, create a global environment where gold’s neutrality and permanence offer particular appeal.

The convergence of economic, political, and military conflicts across multiple continents represents an unusually concentrated period of global instability that historically correlates with strong gold performance.

“Fear of Missing Out” Accelerates Momentum

Retail and Institutional FOMO Intensifies

Analysts note that a “fear of missing out” phenomenon is now contributing to gold’s acceleration beyond levels justified solely by fundamental factors. As prices break successive record highs, previously skeptical investors rush to establish positions, creating self-reinforcing momentum.

This FOMO dynamic is particularly evident in retail investor behavior, where social media discussion of gold’s performance drives additional buying pressure. The combination of fundamental support and momentum-driven flows creates an especially powerful rally dynamic.

Technical Breakouts Trigger Algorithmic Buying

Gold’s breach of the psychologically significant $4,000 level likely triggered substantial algorithmic and momentum-based buying strategies. Many quantitative trading systems use technical breakouts as signals, amplifying moves beyond key resistance levels.

This technical dimension supplements fundamental drivers, creating multiple layers of buying pressure that sustain the rally even during brief periods of profit-taking or consolidation.

Silver, Platinum, and Palladium Rally in Gold’s Wake

Silver Approaches All-Time High at $49

Gold’s strength has lifted other precious metals, with silver gaining 2.4% to $48.97 per ounce—just shy of its all-time high of $49.51. HSBC raised its average silver price forecasts for 2025 to $38.56 per ounce and for 2026 to $44.50, citing expectations for high gold prices, renewed investor demand, and volatile trading conditions.

Silver’s industrial applications, combined with its monetary metal status, create a unique demand profile that benefits from both economic growth and safe-haven flows during uncertain periods.

Platinum and Palladium Post Strong Gains

Platinum climbed 2.4% to $1,652.80, while palladium surged 4.1% to $1,392.26. These industrial precious metals benefit from gold’s halo effect, as investors seeking precious metals exposure often establish positions across multiple metals to diversify within the asset class.

The industrial demand components for platinum and palladium—particularly from automotive catalytic converter manufacturing—provide additional fundamental support beyond pure investment flows.

Major Banks Turn Bullish: Price Targets Surge

WisdomTree Forecasts $4,530 by Q3 2026

WisdomTree commodities strategist Nitesh Shah acknowledged that gold reached the $4,000 level “closer to the end of the year” than initially expected but reaffirmed the firm’s forecast that prices will hit $4,530 per ounce by the end of the third quarter of 2026.

This bullish target implies further upside of approximately 12% from current levels, suggesting that even after gold’s extraordinary year-to-date performance, major financial institutions see continued appreciation potential.

Investment Banks Revise Forecasts Upward

Multiple investment banks have raised their gold price forecasts throughout 2025 as the metal repeatedly exceeded previous targets. This pattern of upward revisions reflects the strength and persistence of the fundamental factors driving gold’s rally.

Deutsche Bank, UBS, HSBC, and other major institutions now maintain structurally bullish outlooks for gold through 2026, anticipating that the combination of accommodative monetary policy, geopolitical risks, and sustained investment demand will keep prices elevated.

Outlook: Factors Supporting Continued Strength

Multiple Catalysts Remain Intact

Analysts expect the confluence of factors that drove gold to $4,000—including strong ETF inflows, central bank buying, and lower US interest rates—to remain supportive through 2026. The structural nature of many bullish drivers suggests gold’s rally may have significant runway remaining.

The return of developed-market ETF demand after a five-year absence represents a particularly significant development, as Western institutional capital provides enormous potential buying power that has only begun to flow back into gold.

Potential Headwinds to Monitor

UBS analyst Giovanni Staunovo noted that “one headwind for gold would be the Fed getting more hawkish,” though he assessed this risk as limited given political pressure for lower rates. A significant hawkish pivot by the Federal Reserve—though currently unlikely—could challenge gold’s upward trajectory.

Additional potential headwinds include resolution of major geopolitical conflicts, a surge in US dollar strength, or an unexpected economic acceleration that diminishes safe-haven demand.

For insights on global economic developments and market trends, visit Singha Darbar.

Conclusion: A Historic Milestone in Precious Metals

Gold’s breakthrough above $4,000 per ounce represents a watershed moment in precious metals markets, reflecting a convergence of powerful forces that have propelled the yellow metal to unprecedented heights. With 54% year-to-date gains, record ETF inflows, sustained central bank buying, and multiple geopolitical crises creating safe-haven demand, gold has established itself as 2025’s standout asset class.

The historic nature of this rally—outperforming equities, bitcoin, and virtually all other major assets—underscores gold’s enduring appeal during periods of uncertainty and monetary policy transition. As the Federal Reserve prepares for additional rate cuts, the US government shutdown continues, and global geopolitical tensions remain elevated, the fundamental backdrop for gold appears exceptionally supportive.

Whether prices reach WisdomTree’s $4,530 target by Q3 2026 or consolidate at current levels, gold’s performance in 2025 will be remembered as one of the most remarkable rallies in the precious metal’s long history—a flight to safety that achieved historic

Comments